Trading Indices

Stock indices utilize the general performance of a group of companies, speculating on one of the entire market instead of selling individual stocks. In Binomo website, popular indices like the S&P 500, NASDAQ, FTSE 100, and Nikkei 225 give exclusive chances to trade according to the general performance of a specific economic sector or nation’s market. Each index has certain characteristics based on its construction and weight allocation. Technically-weighted indexes like NASDAQ respond differently to news of breakthroughs than value-weighted indexes with blue-chip companies. A knowledge of the differences, proper trading choices can be made.

Influence of Economic Data over Indices

Unemployment data, GDP releases, and inflation releases introduce predictability in the pattern of stock index volatility. US indices typically experience significant action from the US monthly jobs report, while European economic releases impact FTSE and DAX movement. They are dated, providing formatted trades with pre-defined risk criteria. Production and services sector information directly relates to determinations of economic health imposed upon performance of indexes. PMI figures above 50 should ideally be positive support for index strength, while figures below 50 will often signal economic weakness to result in loss within indexes.

Sector Rotation Strategies

Various economic cycles favor various market sectors with rotation patterns that can be utilized by experienced traders. Cyclical industries such as technology and consumer discretionary are favored by expansion economies, while relative strength in recession economies is found in defensive industries such as utilities and consumer staples. Knowing which industries tend to dominate certain indices allows one to forecast performance under varying market conditions. The pro-technology bias of the S&P 500 makes it more susceptible to news about innovation and regulation, whereas more diversified indexes can exhibit more consistent patterns of performance.

Central Bank Policy Effects

Interest rate decisions and monetary policy announcements have robust effects on the performance of stock indices through numerous channels. Lower interest rates tend to hold equity valuations by reducing discount rates and encouraging investment, while rate rises can strain indices by increasing borrowing costs and competition with fixed-income products. Quantitative easing policy programs and balance sheet policy have direct liquidity effects in favor of more stock markets. Understanding the size and timing of these policy instruments are worth predicting direction and volatility of indices during policy transition periods.

Corporate Earnings Season Navigation

Quarterly earnings periods create very coherent patterns of volatility in the indices whose performance is very highly correlated with the ratio of firms which beat or match analyst expectations. There are typically four earnings periods in a year, providing reliable trade opportunities to experienced traders. When the prominent companies provide positive or negative guidance, entire indices experience long-term directional movements that create enormous trading opportunities.

Global Market Interconnections

Present day financial markets are increasingly correlated with large market moves finding their way to other markets very quickly. Asian action often sets up opening levels for Europe, and European action sets American tone. Awareness of these time zone realities provides trading advantages during transitions in the market. Risk-off and risk-on mind-set adjustments cause synchronized moves between world indices, with the magnitude of the response depending on local economic fundamentals and market setting. Emerging market indices are more apt to see heightened volatility during periods of global uncertainty compared to developed market benchmarks.

Technical Analysis Applications

Indices remain nearer to technical levels than individual stocks because of the variety of stocks in indices and the larger volume. Supports and resistances, trend lines, and chart patterns will be stronger if used on leading indices rather than individual stocks. Moving averages work particularly well with index trading because averaging the nature of indices filters out stock noise and gives cleaner trend signals. Well-known moving averages like 50-day and 200-day provide highly followed levels that generate high trading interest.

Volatility Index Relationships

The VIX and other volatility measures provide more detailed insights into the level of fear and complacency in the stock market. Market bottoms are most often underpinned by spikes in the VIX, and all-time-low VIX readings can signal risk complacency to rebalance the markets. Awareness of the inverse relationship between the stock indices and volatility indices allows us to better time our entries and exits. During high volatility conditions, stock indices will be good buying opportunities, and during low volatility conditions, more conservative positions can be taken.

Market Opening and Closing Patterns

Stock indices behave differently across different trading sessions. Openings are more volatile as overnight news is digested and positions are rearranged. The final hour of trading typically sees colossal activity since institutional investors lock daily positions. Overnight gap analysis provides excellent directionality insight into indices, particularly where gaps occur due to breaking leading news stories. The latter’s tendency to fill provides trading opportunities but requires direction confirmation prior to opening positions.

Economic Calendar Integration

Lucrative index trading requires comprehension of upcoming economic announcements and company events which are likely to impact sentiment in the market. Fed meetings, employment announcements, and inflation reports introduce expected volatility on which ready traders can take advantage with proper positioning.

Dividend and Corporate Action Effects

Ex-dividend dates induce systematic price action in indices that rely on the exposures of the constituent stocks to dividends. Awareness of these technical adjustments prevents confusion in moments when indices appear to decline without any underlying motive. Stock splits, spin-offs, and reconstitutions of indices will induce short-term discrepancies in index action that present opportunities and risks for active traders. Awareness of these technical drivers prevents misinterpretation of price action. Understanding the mechanics of the system allows traders to position themselves in favorable times when markets revert to normal operations.

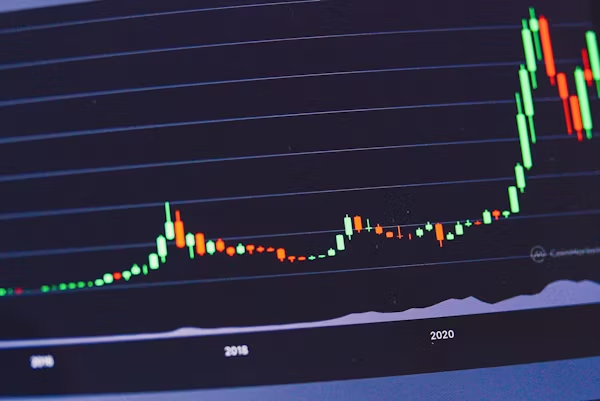

Long-term Trend Identification

While trading with binomo binary options has more limited time perspectives, understanding longer-term trends within the indexes is necessary in guiding shorter-term choice. Secular bull and bear markets set directional tilts that influence the probability of success of strategies. Several-year population patterns, disruptive technology, and policy changes work behind index performance. This type of insight into longer-term forces helps to align shorter-term trading choices with more powerful market flows and not against them. Successful trading of the stock index requires the combination of economic expertise with technical analysis ability and thorough monitoring of all the variables influencing overall market temperament and behavior.